Taking on a big corporate

Fundraising campaign by

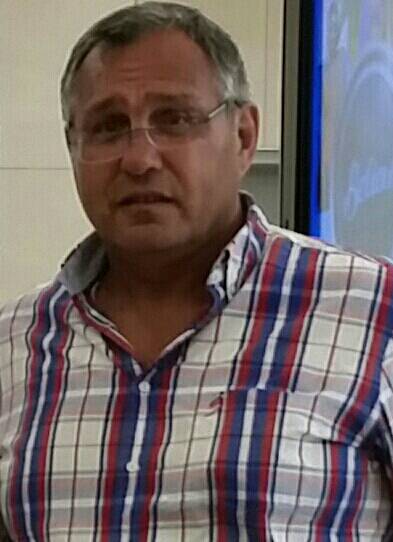

Johannes du Plessis

-

US$0.00raised of $120,000.00 goal goal

No more donations are being accepted at this time. Please contact the campaign owner if you would like to discuss further funding opportunities

Campaign Story

I am a South African citizen living in Mozambique for the last 18 years. I am married and we were blessed with some very beautiful children. My wife and I are both Christians and are trying to educate our children accordingly. Our main business at the moment is agricultural. We are also involved in some community projects like providing water to local community, developed and maintain a clinic for the local community who is very poor as well as supporting the local football club financially to ensure the youth has something to keep them busy.

I am involved in an arbitration case with Riversdale Mining and Rio Tinto which I had funded myself to date with approximately USD 160 k. My own funds had dried up now and this is already causing havoc with the cash flow of our agricultural business. We need to raise a further USD 120 k urgently to ensure we can continue with the case. These funds will be used solely to pay for our legal team, arbitrator and other costs relating to the case. Should I not be able to raise this I will have to withdraw from the case which will have the effect that i become liable for their costs as well.

The successful outcome of the case will ensure that we will have funds available to expand our agricultural business that will create more employment opportunities for the local community, who lives a very poor and difficult life. It will also provide us with funding to invest more into projects to socially uplift the community. We as a family will also benefit substantially from it and I will have the funds to ensure proper education for our children to ensure a better future for them.

The history of the case can be summarised as follows:

I was a shareholder and Managing Director of ELGAS, SA a company registered in Mozambique. The main business line of ELGAS at the time was to identify, develop, own and operate power stations in Mozambique and to sell the power to end users and utilities in the Southern Africa region. I came to know of Riversdale Benga mine development in Mozambique through the press and as I could not pick up anything about a power station development, I decided to contact them to discuss the possibility of developing a power station using low quality thermal coal from their mine.

Therefore I made contact with Syd Parkhouse who was Riversdale’s country manager at the time, based in Mozambique. He then arranged a meeting with the then Chairman and CEO Michael O’Keefe (Michael) during a visit to Mozambique early 2007. Also attending the meeting were Andrew Love (Andrew), Deputy Chairman, as well as other senior members from the management of Riversdale.

After a lengthy discussion of the advantages a mine mouthed thermal power station will have for Riversdale, like increased IRR, market for low quality coal that can not be exported, no stockpile or re-introduction to pit cost of low quality thermal coal, they said that they would be interested to develop the power station jointly with ELGAS.

I then explained to them what the process is that we will have to follow of witch the main points were:

- First we need to get a despatcho from the Minister of Energy that will give us permission to continue with development of project. For this we needed to submit a desk top study with our application to the Minister. The Minister also needed to get Cabinet approval as the power station would be bigger than 100MW

- Then we need to engage with EDM (Mozambican power utility) to get the project listed with them, get transmission access for evacuation of power, to get it registered with Southern African Power Pool (SAPP) and to negotiate a Power Purchase Agreement (PPA) with them as some of the power will have to stay in Mozambique.

- Negotiate with the Ministry of Energy a Framework Agreement that will give us full rights to develop the power station and will be the base for the final concession agreement.

- Get Environmental Impact (EIA) approval and license

- Engage Eskom in negotiations for a PPA as they were in need of power for the SA market as well as that a PPA with them will make the project bankable and enable the financing of it.

I also explained to them that I foresee 2 main problems, namely firstly that our development will be in direct conflict with VALE’s Moatize power station that was already approved and that we will have to compete with them for transmission access and market and secondly the restraints on the current transmission infrastructure which only had about 600MW spare capacity available to evacuate the power to the market. Due to this transmission constrains we then decided that the power station will be developed in two phases with a first phase of 500MW and a second phase of 1500MW once new transmission infrastructure was developed, giving a total of 2000MW but that we will do the EIA study for 2 000MW to save time and costs in future. The 500MW first phase was later increased to 600MW after Riversdale realized that they will need more power for their own developments than originally thought.

It was then decided that if I can achieve to get the despatcho for the first phase Riversdale will fully support the project. To achieve this I then engaged Cliff Lewis (Cliff) of FTech to assist me on the technical side in preparing the desktop study that we needed to submit to The Minister of Energy with our application. I was succesfull to get a despatcho from the Minister in November 2007 making use of my political contacts like Dr Paulo Zucula, Minister of Transport and Gildo Sibumbe, Commercial Director of HCB, who are both personal friends of mine for many years. Thereafter we started working on the various elements of the project to achieve a bankable feasibility study. To this end Ftech was appointed as technical consultants for the project.

Riversdale left me fairly on my own to get the milestones in place which I had achieved as follows using my political contacts:

- Opened discussions with EDM

- Got project registered with SAPP

- Got transmission access on existing infrastructure (220MW) – August 2009

- Got Framework Agreement signed by Minister – September 2009

- Opened discussion with Eskom using my contacts there

- Got EIA approval – September 2009

- Got project listed by SAPP as one of 10 to be fast tracked in the region

All this time there was a lot of pressure from VALE to stop the Benga Power Project (BPP) development and we could achieve the above only through my political contacts. Even when Riversdale could not get a meeting with Minister Zucula, I facilitated a meeting for Michael, Andrew and other Riversdale Board members to discuss their transport and port needs for the mine.

More or less July 2009 Andrew Love informed that the Board of Riversdale realized that BPP is a valuable project that can contribute tremendously to the business of Riversdale and therefore they took a decision that they must get more involved in the project with me. To this end they decided that he will drive the project from Board level. Towards the end of 2009 or early 2010, can’t remember exactly, Brendon Jackson was appointed to assist Andrew in this role that the Board had placed on him.

During the course of 2010 I had engaged various parties in negotiations to invest in ELGAS due to cashflow constrains we had experienced at the time and the inability of existing shareholders to resolve the problems. I had disclosed these facts to members of the Riversdale Board and introduced them to some of the more serious parties I was negotiating with, due to the importance of BPP.

In September 2010 Riversdale Mining had indicated to us that they would like to engage with us regarding buying 100% of ELGAS as it is their desire to have full control of BPP. The shareholders of ELGAS approved these negotiations and due to the relation we had and the morality involved I broke off all negotiations with everybody else we were negotiating with at the time even though we had a letter of intent from one of them and they saying they will pay 10% more than what Riversdale will offer. We then started negotiating the transaction and Riversdale started a full due diligence on ELGAS which was completed more or less at the end of October 2010. Grant Thornton was appointed to do the financial due diligence and Rita Cassimiro, with assistance from Carla Ribeiro (from Riversdale), the legal due diligence. Negotiations was done between Andrew, Cliff and myself and nobody else was involved.

During November 2010 we concluded the negotiations and the shareholders of ELGAS approved it. The transaction was structured as follows:

- Ftech Limited, a new company to be registered in Mauritius, will buy 100% of ELGAS. If they can not get 100% the transaction will not continue

- Riversdale Mining will provide the funding to Ftech to buy the shares, pay out shareholders loan accounts and to re-capitalize the company. Ftech will register a new company in Mauritius for this purpose

- BPP will be transferred out of ELGAS to a company to be nominated by Riversdale

- The effective date for determining assets and liabilities was 31 October 2010 which was also the date from where FTech will effectively take over.

The terms and conditions as negotiated were there after summarized in a term sheet by the then Deputy Chairman of Riversdale, Mr Andrew Love on 1 September 2010. This term sheet was presented to the shareholders of ELGAS by me for approval in writing. All of them accepted it in writing (have copies of documents). On 1 November 2010 the Term Sheet for me personally was changed after re-negotiations between Andrew Love and myself due to some issues that came out during the due diligence and because they wanted to change the terms and conditions of my employment as well as bring in the Restraint of Trade. All shareholders of ELGAS accepted the sale of the company to Ftech/ Riversdale at a shareholders meeting attended by all shareholders on 18 November 2010 (have copies of agenda and minutes). Rita Cassimirro acted as Secretary of the meeting to ensure all was done according to law as well as wrote the minutes and a representative of Riversdale attended the meeting to observe. Carla assisted with drafting of the agenda and minutes to ensure it was all acceptable to Riversdale.

Andrew, Cliff and I then continued to negotiate the final terms and conditions of the various Sale of Shares Agreements, a separate one for every shareholder of ELGAS as well as the employment, Restraint of Trade and Share Subscription and Loan Agreement for myself based on the term sheets. Charles Marais of the firm Eversheds was appointed to draft the agreements and Carla had the role to ensure that we adhere to Mozambican Law. Brendon functions were to manage the process although Andrew was very involved as we were working on a very tight time schedule. African Legend signed their agreement for the sale of shares in ELGAS on 19 November 2010 as their representative was in Maputo for the shareholders meeting the 18th and did not want to come again to Maputo due to costs and time involved, ENH and EDM signed their agreements on 22 November 2010 in front of a public notary based in the Department of Finance which is required by law for public entities and Rory Harbinson and I signed our agreements on 7 December 2010 together with my employment agreement, my Restraint of Trade Agreement as well as my Share Subscription and Loan Agreement. By the time I had signed these agreements all other shareholders had already signed their agreements with the effect that Ftech had acquired all (100%) of the shares in ELGAS.

The reason for the time difference from when the others had signed and the time I had signed we were waiting for Riversdale to pay the fees for the Public Deed i.r.o. ENH and EDM to make their agreements legally binding. This was handled by Carla and was paid on 24 November 2010 (copies of receipts available). We also waited for Ftech’s company documents like statutes, certificate of incorporation, etc to come to Maputo from Mauritius through the Mozambican embassy in South Africa to the Department of Foreign Affairs in Maputo and from there to the Public Notary to enable the Notary to issue the Public Deed for ENH and EDM. As FTech was a new registration this took longer than anticipated and on 30 November 2010 Andrew issued a letter to ELGAS to ensure the shareholders of Riversdale and Ftech’s commitment to finalise the transaction (have copy of letter). Between Andrew, Cliff and myself we agreed in me delaying in signing my contracts until the Public Deeds were issued and the loan agreement between Riversdale and Ftech has been completed and signed.

These agreements had all basically the same condition president as clause 4, namely that Ftech acquires all the shares in ELGAS within 7 days after the signature date of the agreements which was 7 December 2010. As I was the last one signing the Sale of Shares agreement this condition precedent was fulfilled and therefore all agreements became unconditional.

Subsequently to this I was informed in writing by Ftech on 8 December 2010 that all conditions precedent were fulfilled and that the agreements are therefore unconditional as of the date of the letter. Similar letters were sent to all the shareholders of ELGAS informing them that all Sale of Shares agreements had become unconditional. It is important to take notice of the fact that Ftech was a signatory to the Restraint of Trade Agreement with Riversdale so in effect this notice meant that the condition precedent for this agreement was also met as it is the same for all agreements. I also received an Irrevocable Guarantee from Riversdale regarding the obligations of Ftech to me under the Sale of Shares Agreement as they had felt all conditions precedent was met.

As Riversdale felt comfortable that all conditions precedent had been met they had released funding to Ftech which was received by Ftech on 10 December 2010 as per an e-mail from Maya Kandye of Turnstone Mauritius to Dr Cliff Lewis (Cliff), representative of Ftech. This was confirmed in a letter by Riversdale to Cliff dated 14 December 2010 as well as instructions on how Ftech should deal with the funds that was released by Riversdale. Cliff instructed Turnstone on 14 December 2010 to release funds to all shareholders as per the instruction from Riversdale through Andrew Love. This all happened within the 7 day period after I had signed the agreements which is further proof that Ftech and Riversdale at the time accepted that the conditions precedent of all agreements were met. Also the way I know Andrew he would not have made any payment if his legal team under Carla did not advise him that he can go ahead and make payment as CP’s are met.

This was duly done as per Annexure 10 on 15 December 2010 by Turnstone and I received my payment on 17 December 2010. Rita Cassimirro and I then went ahead to transfer the shares to FTech of which most was completed by 21 December 2010 except for 15% held by EDM as the share certificates were lost by KPMG and we had to reissue them and pay stamp duties before it could be transferred to Ftech which happened on 23 December 2010 (some copies of certificates available). This could not have been done sooner as we had to wait for the Department of Finance to calculate the stamp duties and it was difficult to get the signatures from the various shareholders as most of them are in senior management positions and are very busy and travelling a lot. However Rita and Carla kept on ensuring me over this period that this does not influence the contracts and that all contracts were valid and binding.

Thereafter there was no problem and Ftech and Riversdale kept on making payments to me as per the Sale of Shares Agreement, Employment Agreement and the Restraint of Trade Agreement. Riversdale kept on providing Ftech with the necessary funds to meet their obligations under the Sale of Shares Agreement and the Employment Agreement. Obviously the then Board of Directors of Riversdale, with whom all the negotiations were concluded with, had felt that all conditions precedent as per the various agreements had been fulfilled or they would not have made the payments. To the best of my knowledge all payments were approved by Andrew Love who had led the negotiations for Riversdale and signed the agreements on behalf of Riversdale.

The problem started in June 2011 when I had send an e-mail to Brendon Jackson (BJ) of Riversdale. The result of this was that Cliff came to Maputo to meet with me on 13 June 2011. He said to me that he was send to me by Rio Tinto (who was then in the process of taking over Riversdale) / Riversdale to discuss with me an earlier payout of the obligations under the agreements as well as a payout under the Share Subscription and Loan Agreement. We got in a debate of what the value of the 1,5% share option should be, more specifically on what I should pay for the shares at financial close of BPP. In the end I fetch my copy of the Share Subscription and Loan Agreement and he agreed with me that my interpretation is correct. Telephonically Cliff confirmed with Charles Marais, who authored the agreements and acted as attorney for Riversdale during our negotiations, that my interpretation was correct. We then did a valuation together on the latest financial projections that was available at the time. We concluded that the discount (difference in price I will pay and estimated value of shares) I will receive at financial closure will be +/- USD 18 million. We further calculated the net present value of estimated future dividends to be +/- USD 25 million over a 20 year period, giving a total value of USD 43 million. Cliff then said to me that due to them understanding the agreement differently they had expected to pay a much lower amount and he will discuss it with Rio Tinto and get back to me as we agreed that the way forward is that they must make an offer and we then take it from there.

This perhaps is the core of the current problem as they had expected to buy me out at a low value as well as at the time they started with this, there was already a feeling that they had paid too much for Riversdale which had resulted in huge write offs by Rio Tinto regarding this investment. Also their CEO, who was CEO during the times of the Riversdale takeover, was sacked as per various articles in the newspapers quoting the Riversdale take over and the subsequent devaluation and write-off of the investment as one of the reasons why he left.

Not long after our meeting Cliff got back to me to say that he was instructed to not further deal with this matter and that Steve Mallyon will contact me.

I summarized our discussions in an email to BJ who had indicated to me in an earlier e-mail dated 14 June 2011 that he and Steve Mallyon (Steve) would like to meet with me in Johannesburg. At the time Steve was the Managing Director of Riversdale. By this time Rio had successfully taken over Riversdale.

As a result of my e-mail Steve wrote me a letter on 21 June 2011. We finally met on 13 July as per an e-mail from Carla Ribeiro in Maputo at the Riversdale office where we had basically the same discussion as previously with Cliff. Steve also made a remark that he will advise me that it is sometimes better to rather take a payment at a lower value earlier than waiting for a later stage as projects like this can be delayed by big companies like Rio. I said to him that it is over to them to make an offer and then we can take it from there. As Rio was starting to put their own people into management positions Steve was now a consultant. He undertook to get back to me early August as he need to consult with Rio, but never did. Early September 2011 I followed up with him but he said he had no direction from Rio and refer me to BJ. He once again thank me for what I had done to ensure BPP success and said without me would not have been possible

From there on I kept on asking Brendon for clarity and information and he kept on saying that he will get back to me. In the meantime Riversdale kept on making the payments to me as per the various agreements until all was paid. Then on 17 January 2012 I was informed that Mark Grenning is the new contact person for me at Rio regarding these issues.

On 28 January 2012 I requested a letter to state that I had met all my obligations under the 3 agreements (Sale of Shares Agreement, Employment Agreement and the Restraint of Trade Agreement) for which I had received full payment by then. Mark Grenning(Mark) then informed me that he is new contact person per agreement and he does not see a need for the letter.

I met with Mark and Carla Ribeiro at my home in Maputo on 15 February 2012 but nothing substantial was discussed and Mark said he needed a couple of weeks to get back to me regarding Rio’s position. Mark asked me during the meeting what I want and whole thing became same as previous two meetings. Asked me how I understand contract and I explained. Asked my understanding bigger or smaller than 600MW- sit down negotiate and come to an agreement regarding 1,5%. Rio to make an offer according to agreement. From there on various e-mails flowed between us but I could not get any answers from Rio or information regarding BPP.

Then on 21 May 2012 I received an e-mail from Mark saying that the Share Subscription and Loan Agreement as well as the Restraint of Trade Agreement had lapsed according to Rio Tinto as the condition precedent was not met. This I informed them I disagree with and will therefore revert it for dispute resolution according to the agreement.

We had further correspondence regarding this on 29 May 2012. The final result of all this was that we agreed on an arbitration agreement and the process is ongoing.

Organizer

- Johannes du Plessis

- Campaign Owner

No updates for this campaign just yet